are political contributions tax deductible for corporations

Your business cannot deduct donations expenditures or political contributions on your business tax return. According to the IRS.

Tax Deductions For Donations In Europe Whydonate

There are five types of deductions for individuals work.

. A political contribution is not often regarded as a viable expense in a business and therefore cannot be deductedEven if you write checks to a political party there are a lot of ways to financially support a cause. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. Businesses that incur political expenses need to have a solid grasp of the distinctions explained above.

Contributions or donations that benefit a political candidate party or cause are not tax deductible. Are Political Donations Tax Deductible Uk Ictsd Org. Usually theyre not deductible.

Are political contributions tax deductible. The decision to contribute is made knowingly and voluntarily by the minor. Cost of admission to a political event including.

But contributions to candidates and parties arent deductible no matter who makes them. Are Political Donations Tax Deductible. An individual who is under 18 years old may make contributions to candidates and political committees subject to limitations if.

S34 1 Income Tax Trading and Other Income Act 2005 S54 1 Corporation Tax Act 2009. The funds goods or services contributed are owned or controlled by the minor proceeds from a trust for which he or she is a beneficiary or funds withdrawn by the. According to the IRS.

The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations come under those opted purely by choice and hence can not be recognized as tax-deductible as per IRS rules and regulations. The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are not tax-deductible. Many donors ask our service team the same question.

Is A Political Donation A Business Expense. It depends on what type of organization you have given to. You cant deduct contributions to organizations that arent qualified to receive tax-deductible contributions including political organizations and.

The longer answer is. Political contributions made to repeal or support a certain law on the other hand are not deductible. A tax deduction allows a person to reduce their income as a result of certain expenses.

It is possible for the Company to deduct 100 of the amount donated to a political party under section 80GGB for tax purposes. However in-kind donations of goods to qualified charities can be deductible in the same way as cash donations. Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible.

Some contributions can be made to the educational arm of a political organization when those arms are qualified under IRS Code section 501 c 3 or 4. Consequently you can make political donations according to your preferences and claim these deductions in your taxes. A 501c3 organization is a United States corporation trust unincorporated association or other type of organization exempt from federal income tax under section 501c3 of Title 26 of the United States CodeIt is one of the 29 types of 501c nonprofit organizations in the US.

Advertisements in a political convention program or politically affiliated publication. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in Federal state and local elections and to contribute to the campaign funds of the candidate or party of their choice are deductible by the taxpayer under section 162a of the Internal Revenue Code of 1954 provided such expenditure classified as. That includes donations to.

Companies researching the impact of a new law for example can deduct the costs related to that research. Political contributions arent tax deductible. Payments made to the following political causes are also not tax deductible.

The short answer is no they are not. This means that if you donate to a political candidate a political party a campaign committee or a political action committee PAC these contributions will not be tax-deductible. You cant deduct contributions to organizations that arent qualified to receive tax-deductible contributions including political organizations and candidates.

While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to. 501c3 tax-exemptions apply to entities that are organized and operated exclusively for religious.

Are Political Contributions Tax Deductible

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Taxact Blog

-RIVR-Financial-wxvJ4BoBoYS2RDNeP.png)

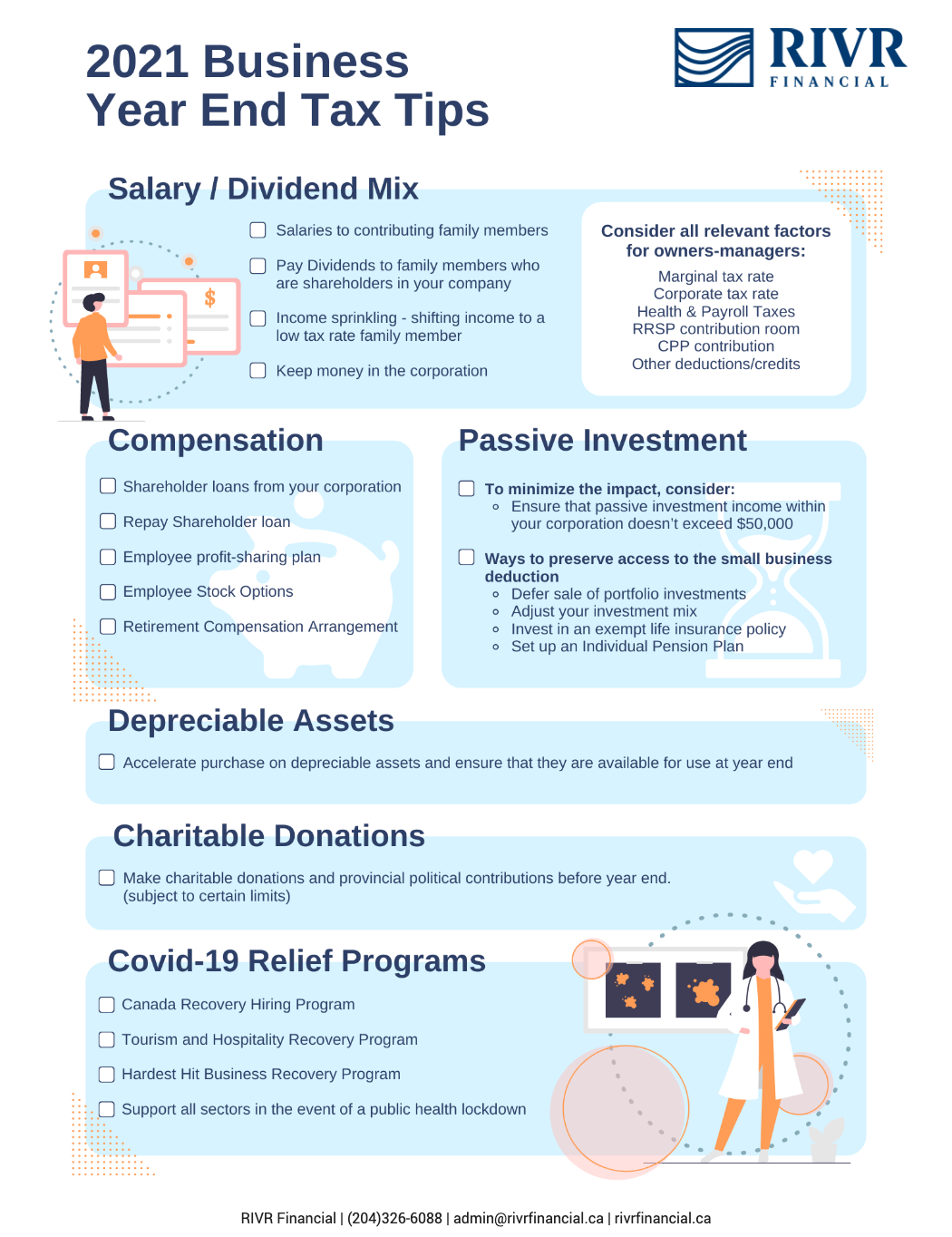

2021 Year End Tax Tips For Business Owners Rivr Financial

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

Are Political Contributions Tax Deductible Tax Breaks Explained

Are Political Contributions Tax Deductible Anedot

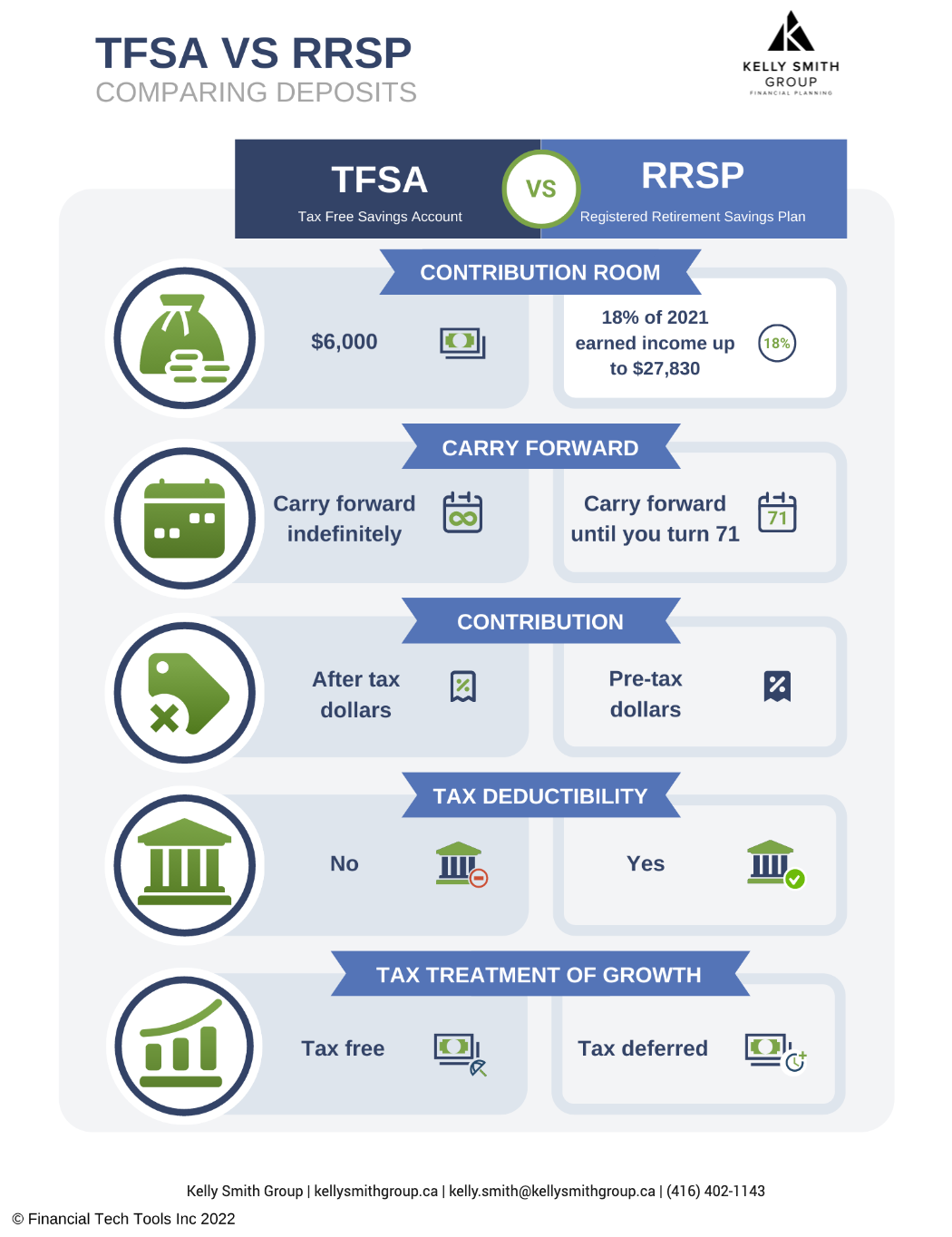

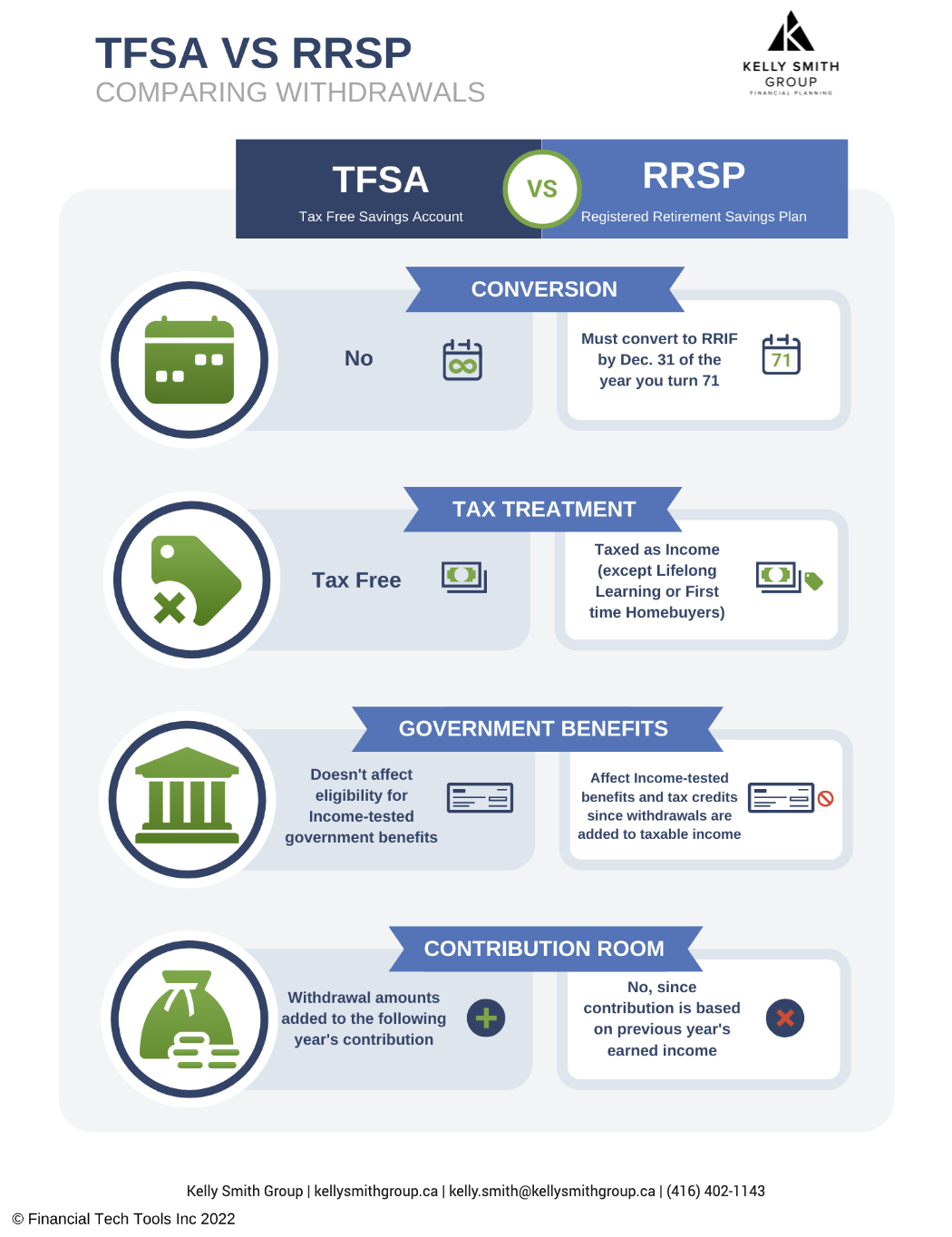

Tax Free Savings Account Archives Kelly Smith Group

Are Municipal Political Donations Tax Deductible In Canada Ictsd Org

A Case For A Refundable Federal Political Contributions Tax Credit Ottawa Law Review

Political Financing Handbook For Registered Parties And Chief Agents Ec 20231 June 2021 Elections Canada

Are Political Contributions Tax Deductible H R Block

Tax Planning Tips For End Of 2018 Accuracy Plus Tax And Services

Are Political Contributions Tax Deductible

The Secret Donors Behind The Center For American Progress And Other Think Tanks Updated On 5 24 In 2022 Think Tank Progress Education Reform

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

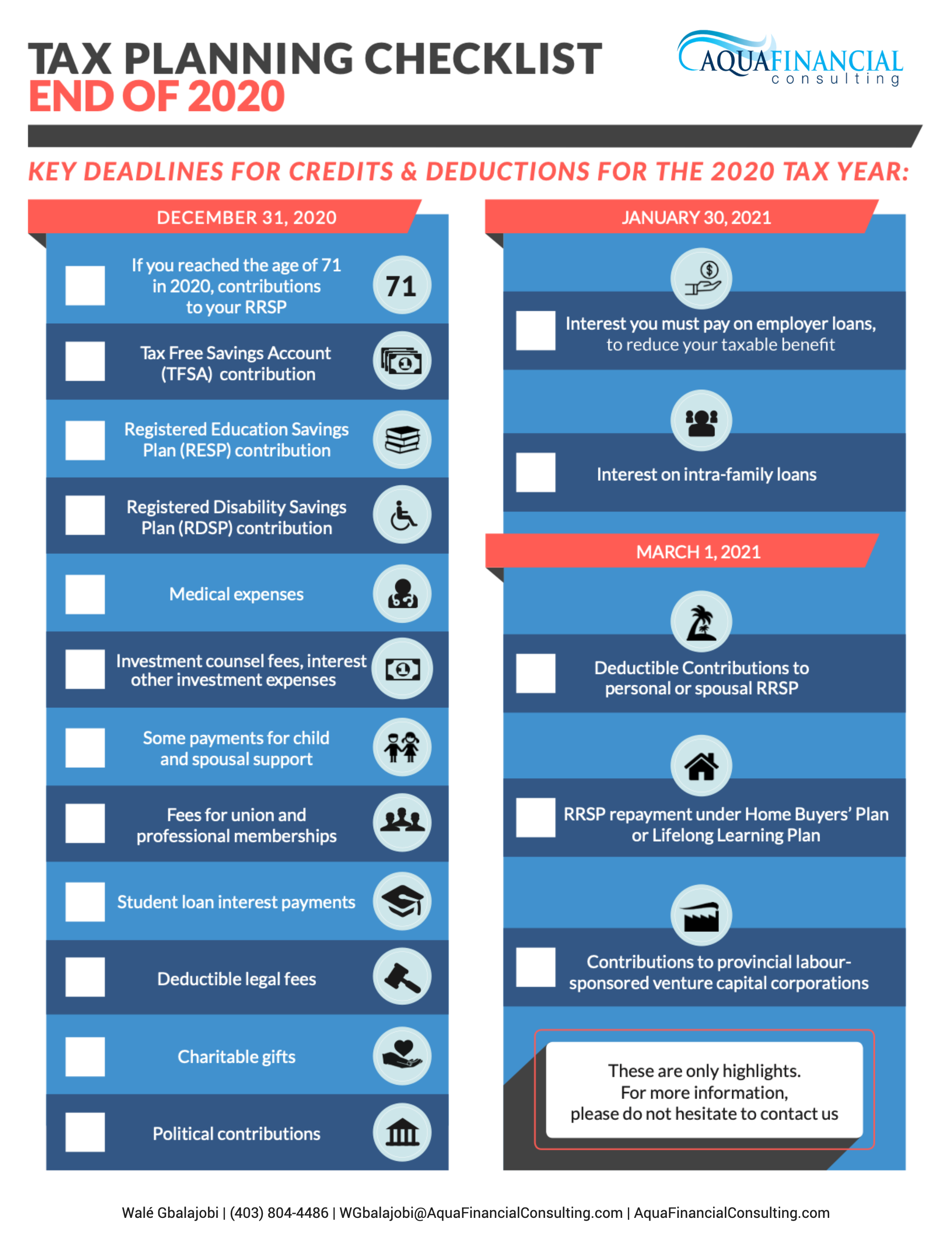

Personal Tax Planning Tips End Of 2020 Tax Year Aquafinancial Consulting

Are Political Contributions Tax Deductible For Partnerships Ictsd Org